Calculate va sales tax

The Virginia VA state sales tax rate is currently 43. Prescription Drugs and non-prescription drugs are exempt from the Virginia sales tax.

Sales Tax Calculator Taxjar

In all of Virginia food for home consumption eg.

. Choose city or other locality from Virginia below for local Sales Tax calculation. The base state sales tax rate in Virginia is 43. Grocery items and cer tain essential personal hygiene items are taxed at.

Code 581-2402 Virginia levies a 415 Motor Vehicle Sales and Use SUT Tax based on the vehicles gross sales price or 75 whichever is greater. You can see the total tax percentages of localities in the buttons. The average cumulative sales tax rate in Richmond Virginia is 6.

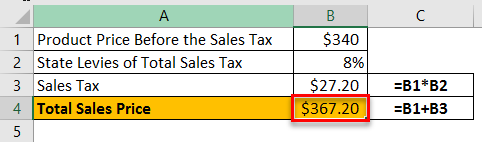

70 455 7455. Divide tax percentage by 100. Numerous services are also subject to sales and.

Richmond has parts of it located within Chesterfield County and Henrico County. In some parts of Virginia you may pay up to 7 in car sales tax with local taxes. The actual sales tax may vary depending on the location as some countiescities charge additional local taxes.

Then add that amount to the purchase amount to find. Fast Processing for New Resale Certificate Applications. In addition to that 53 rate localities in the Northern Virginia Central Virginia and Hampton Roads regions collect a 070 sales tax bringing the total in these areas to 6.

Motor Vehicle Sales and Use Tax. Please select a specific location in Virginia from the list below for specific Virginia Sales Tax Rates for each location in 2022 or calculate. Collect sales tax at the tax rate where your business is located.

70 0065 455. Produce critical tax reporting requirements faster and more accurately. Multiply the decimal form by the total purchase as follows.

Multiply price by decimal tax rate. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. This includes the rates on the state county city and special levels.

The sales tax rate for most locations in Virginia is 53. So whilst the Sales Tax Rate in Virginia is 53 you can actually pay anywhere between 53 and 6 depending on the local sales tax rate applied in the municipality. If you make 70000 a year living in the region of Virginia USA you will be taxed 12100.

65 100 0065. This includes the rates on the state county city and special levels. Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance.

Your average tax rate is 1198 and your marginal tax rate is 22. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara.

Ad Fast Online New Business Virginia Sales Taxes. The Virginia state sales tax rate is 53 and the average VA sales tax after local surtaxes is 563. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Within Richmond there are around 27 zip codes with the most populous zip code being 23223. Virginia Income Tax Calculator 2021. Find your Virginia combined state and local tax rate.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 559 in Virginia. The base statewide sales tax rate of 43 in Virginia is combined with a statewide local rate of 1 meaning the effective floor for sales taxes in Virginia is 53. To calculate the sales tax amount for all other values use our sales tax calculator above.

Local tax rates in Virginia range from 0 to 27 making the sales tax range in Virginia 43 to 7. Add tax to list price to get total price. All numbers are rounded in the normal fashion.

To calculate manually convert the percentage to a decimal. Get a demo today. Tax is imposed on the retail sale lease or rental of tangible personal property in Virginia or the use or consumption of tangible personal property in Virginia.

Virginia charges a 415 Motor Vehicle Sales and Use Tax SUT on the vehicles gross sales price or 75 whichever is greater. 63 James City County. Springfield is located within Fairfax County VirginiaWithin Springfield there are around 9 zip codes with the most populous zip code being 22153The sales tax rate does not vary based on zip code.

The state sales tax rate in Virginia is 43 but you can customize this table as needed. Several areas have an additional regional or local tax as outlined below. Depending on local municipalities the total tax rate can be as high as 7.

Counties and cities can charge an additional local sales tax of up to 07 for a maximum possible combined sales tax of 6. Effective July 1 2016 unless exempted under Va. The price of the coffee maker is 70 and your state sales tax is 65.

Virginia sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. To calculate the sales tax in Virginia you can use a sales tax calculator for Virginia or calculate manually.

You will pay 455 in tax on a 70 item. Sales Tax Rate s c l sr. Virginia has 1199 special sales tax jurisdictions with local.

The state sales and use tax rate in Virginia is 43. For the purposes of the Motor Vehicle Sales and Use Tax collection gross sales price includes the dealer processing fee. For example 53 percent becomes 0053.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Virginia local counties cities and special. Local tax rates broken down by county are also available on the Virginia Tax site. Sales Tax Table For Virginia.

The average cumulative sales tax rate in Springfield Virginia is 6. List price is 90 and tax percentage is 65. You can look up your local sales tax rate with TaxJars Sales Tax Calculator.

Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. 30 x 0053 159.

Virginia Vehicle Sales Tax Fees Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator

How To Calculate Sales Tax For Your Online Store

Sales Tax Definition Types Examples Calculator

Sales Tax Calculator

Sales Tax Calculator Taxjar

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Sales Tax By State Is Saas Taxable Taxjar

Pennsylvania Sales Tax Small Business Guide Truic

How To Calculate Cannabis Taxes At Your Dispensary

Virginia Vehicle Sales Tax Fees Calculator

What Is Sales Tax A Complete Guide Taxjar

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

How To Calculate Sales Tax In Excel Tutorial Youtube

How To Pay Sales Tax For Small Business 6 Step Guide Chart